Home Buying Guide for First time Home Buyers in India 2024

Coimbatore

For many individuals in India, purchasing their first home is a significant milestone, marking a transition towards stability and security. As a first-time home buyer, the journey towards homeownership can be both exhilarating and daunting.

With the Indian real estate market offering an alternative of options, navigating through the process can seem overwhelming.

Considering these factors, it becomes essential to have a thorough guide. We dedicate ourselves to present you a detailed road map that is especially designed to adapt to the special requirements and worries of Indian first-time house buyers.

Whether you're a family trying to settle down or a young professional seeking freedom, our guide is meant to be your reliable move companion on this significant experience.

With insights garnered from years of experience in the real estate industry, coupled with a deep understanding of the Indian market dynamics, our guide is tailored to empower you to navigate the home buying process with ease and assurance.

1. Understanding Your Needs and Budget

Importance of Identifying Your Requirements

Understanding your needs is the cornerstone of the home buying process. It's essential to identify between what you truly need and what you desire in a home. Consider factors such as location, size, amenities, and proximity to essential facilities like schools, workplaces, and healthcare centers.

This clarity will streamline your search and ensure that the chosen property aligns with your lifestyle and long-term goals.

Assessing Your Budget Realistically

Before investigating the home buying process, it's crucial to assess your financial standing realistically. Evaluate your savings, income, and existing financial commitments to determine a feasible budget for your home purchase.

4.Evaluate Knowledge of Local Market Trends:

Assess the agent's understanding of current market trends, property values, and upcoming developments in the specific regions of interest within India.

Factor in additional expenses such as down payment, closing costs, maintenance, and unforeseen contingencies. Setting a realistic budget will prevent you from overextending financially and ensure sustainable homeownership.

Prioritizing Needs Vs Wants

In a market inundated with options, distinguishing between needs and wants is paramount. While it's natural to be drawn to properties with extravagant features and amenities, it's essential to prioritize elements that contribute to your quality of life and long-term satisfaction.

Make a list of non-negotiable requirements and be willing to compromise on secondary preferences. This approach will help you stay focused and make informed decisions based on your priorities and budget constraints.

By understanding your needs and budget upfront, you lay a solid foundation for your home buying journey. This clarity empowers you to navigate through the myriad of options available in the market and make choices that align with your lifestyle, financial capabilities, and future aspirations.

2. Researching Locations and Property Types

Significance of Location in Real Estate Investment

Location is one of the most critical factors influencing real estate investment decisions. A property's location dictates its value, demand, and potential for appreciation over time.

Factors such as proximity to essential amenities, transportation hubs, employment centers, educational institutions, and recreational facilities significantly impact the desirability and resale value of a property.

Additionally, the neighborhood's infrastructure, safety, and overall ambiance play a crucial role in determining its attractiveness to prospective buyers or tenants. Therefore, thorough research and analysis of the location are essential to making a sound investment decision.

Popular Residential Areas in Different Cities Across India

- Mumbai: Bandra, Juhu, Powai

- Delhi: Gurgaon, Noida, Dwarka

- Bangalore: Koramangala, Indiranagar, Whitefield

- Chennai: Adyar, Anna Nagar, OMR (Old Mahabalipuram Road)

- Hyderabad: Jubilee Hills, Banjara Hills, Gachibowli

- Pune: Koregaon Park, Kothrud, Hinjewadi

- Kolkata: Salt Lake City, Rajarhat, Ballygunge

- Ahmedabad: Satellite, Vastrapur, Thaltej

- Jaipur: Vaishali Nagar, Malviya Nagar, Jagatpura

These areas are renowned for their amenities, infrastructure, connectivity, and overall livability, making them prime residential destinations for homebuyers.

Comparison of Various Property Types

Apartments: Apartments are a popular choice for urban dwellers seeking convenience, security, and community living. They typically offer amenities such as elevators, parking facilities, and recreational spaces.

Apartments are ideal for individuals or families looking for a low-maintenance lifestyle with access to shared amenities and services.

Villas: Villas provide spaciousness, privacy, and customization options that cater to discerning homeowners. They often feature individual plots of land, private gardens, and exclusive amenities such as swimming pools or gyms.

Villas are suitable for those who prioritize space, independence, and a higher degree of personalization in their living environment.

Plots: Plots offer the flexibility to build a custom-designed home according to the buyer's preferences and specifications. They provide a blank canvas for homeowners to create their dream residence, tailored to their unique lifestyle and aesthetic preferences.

Plots are ideal for individuals seeking complete autonomy in the design and construction of their home, along with the freedom to choose their builder and architectural style.

When comparing property types, it's essential to consider factors such as budget, lifestyle preferences, long-term goals, maintenance responsibilities, and resale potential. By carefully evaluating these aspects, homebuyers can make an informed decision that aligns with their needs and aspirations.

What are the Popular Residential Areas in Coimbatore?

The ideal location for you in Coimbatorewill rely on your own requirements and tastes. Before choosing, think about your preferences for developed or developing areas, your budget, your lifestyle, and your location in relation to amenities and places of employment.

- Saravanampatti

- Thudiyalur

- Vadavalli

- Thondamuthur

- Karamadai

- Kovaipudur

- Kovilpalayam

- Palladam

- Madampatti

Financing Options and Mortgage Process

Introduction to Different Financing Options

First-time homebuyers in India have access to various financing options to facilitate their home purchase. These options include:

Home Loans: Home loans are the most common financing option for purchasing a property. They are offered by banks, housing finance companies, and other financial institutions. Home loans typically cover a percentage of the property's cost, with the remaining amount to be paid by the buyer as a down payment.

Pradhan Mantri Awas Yojana (PMAY): PMAY is a government scheme aimed at providing affordable housing to all citizens. It offers subsidies on home loans for eligible beneficiaries, making homeownership more accessible and affordable.

Builder Financing Schemes: Some builders and developers offer financing schemes or tie-ups with financial institutions to assist homebuyers in obtaining loans. These schemes may come with special offers or benefits such as lower interest rates or waived processing fees.

Mortgage Process in India

The mortgage process in India typically involves the following steps:

Pre-Approval: Before beginning your home search, it's advisable to get pre-approved for a home loan. This involves submitting your financial documents to the lender for assessment of your eligibility and loan amount.

Property Assessment: Once you've found a property, the lender will conduct a valuation to assess its market worth and determine the loan-to-value ratio.

Loan Application: Submit a loan application along with the necessary documentation, including proof of identity, address, income, employment, and property details.

Credit Appraisal: The lender will evaluate your creditworthiness based on your credit score, income stability, existing debts, and repayment capacity.

Approval and Disbursement: Upon approval of the loan, the lender will issue a sanction letter outlining the terms and conditions. Upon meeting the conditions, the loan amount will be disbursed to the seller or builder as per the agreed terms.

Tips for Choosing the Right Lender and Mortgage Plan

When selecting a lender and mortgage plan, consider the following factors:

Interest Rates: Compare interest rates offered by different lenders to find the most competitive rate. Even a slight difference in interest rates can significantly impact the overall cost of your loan.

Loan Terms: Evaluate the loan terms, including the loan tenure, repayment options, and prepayment penalties. Choose a plan that aligns with your financial goals and repayment capacity.

Processing Fees and Charges: Consider the processing fees, administrative charges, and other associated costs. Look for lenders offering transparent fee structures and reasonable charges.

Customer Service and Reputation: Research the lender's reputation, customer service quality, and turnaround time for loan processing. Opt for a lender known for reliability, responsiveness, and customer-centric practices.

By understanding the financing options available, navigating the mortgage process, and choosing the right lender and mortgage plan, first-time homebuyers can make informed decisions and embark on their homeownership journey with confidence.

Legalities and Documentation

Legal Aspects Involved in Buying a Home in India

Buying a home in India involves various legal aspects that buyers need to be aware of:

Title Verification: It's essential to verify the property's title to ensure that it is free from any encumbrances or disputes. Conducting a thorough title search with the help of a legal expert or property lawyer can help identify any existing claims or legal issues associated with the property.

Approval from Authorities: Certain properties, especially those in gated communities or under development, require approvals from local authorities and regulatory bodies. Ensure that the property has obtained all necessary clearances and compliances as per local laws and regulations.

Stamp Duty and Registration: Paying stamp duty and registering the property with the relevant authority is a crucial legal requirement in India. The stamp duty rates vary from state to state and are calculated based on the property's value. Registering the property establishes legal ownership and safeguards the buyer's interests.

Documentation Required During the Purchase Process

The documentation required for buying a home in India typically includes:

Sale Deed: The sale deed is a legal document that transfers ownership of the property from the seller to the buyer. It contains details such as the property description, sale consideration, and terms of the transaction.

Title Deed: The title deed is proof of ownership of the property and establishes the seller's right to transfer the property to the buyer. It is essential to verify the authenticity and validity of the title deed before proceeding with the purchase.

Property Tax Receipts: Ensure that the seller has paid all property taxes up to the date of transfer. Obtain copies of property tax receipts as evidence of compliance with tax obligations.

Encumbrance Certificate:An encumbrance certificate is a crucial document that verifies the property's ownership and ensures that there are no existing liabilities or charges against it. It is obtained from the local sub-registrar's office and provides a record of transactions related to the property over a specified period.

Common Legal Pitfalls and How to Avoid Them

Undisclosed Liabilities: Verify that the property is free from any undisclosed liabilities such as mortgages, loans, or legal disputes. Conducting a thorough due diligence process, including title verification and obtaining an encumbrance certificate, can help identify any hidden liabilities.

Forgery and Fraud: Beware of fraudulent practices such as forged documents, fake titles, or misrepresentation of property details. Work with reputable sellers, developers, and legal professionals to minimize the risk of falling victim to fraud.

Non-Compliance with Regulations: Ensure that the property complies with all local laws, regulations, and zoning ordinances. Failure to comply with regulatory requirements can lead to legal complications and financial liabilities in the future.

By understanding the legal aspects involved in buying a home, compiling the necessary documentation, and being vigilant about common legal pitfalls, buyers can safeguard their interests and make informed decisions throughout the property purchase process.

Consulting with legal experts or property lawyers can provide additional guidance and assurance regarding the legality of the transaction.

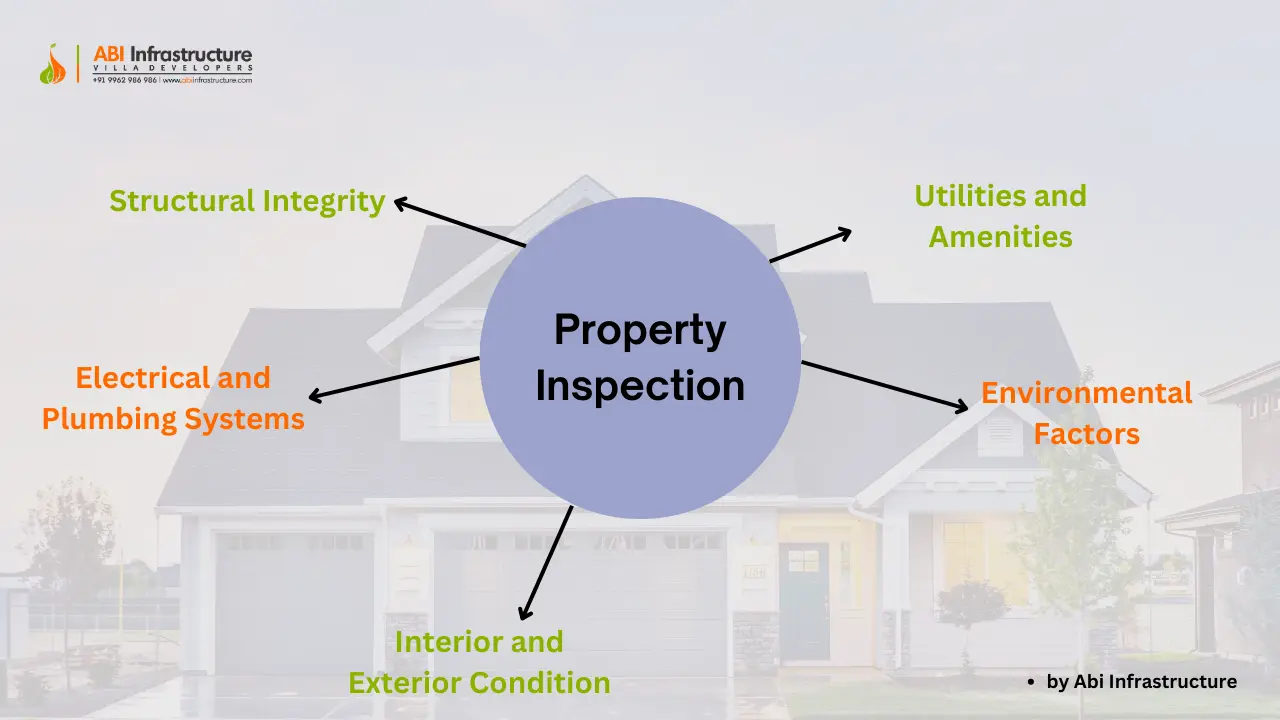

Property Inspection and Due Diligence

Importance of Conducting a Thorough Property Inspection

A comprehensive property inspection is a crucial step in the home buying process as it helps buyers assess the condition of the property and identify any potential issues or defects. By conducting a thorough inspection, buyers can make informed decisions, negotiate repairs or price adjustments, and avoid costly surprises after purchasing the property.

Guide on What to Look for During Inspections

During the property inspection, buyers should pay attention to the following key areas:

Structural Integrity: Inspect the foundation, walls, and roof for any signs of cracks, water damage, or structural issues. Look for uneven floors, sagging ceilings, or bulging walls, which may indicate underlying structural problems.

Electrical and Plumbing Systems: Check the electrical wiring, switches, outlets, and plumbing fixtures for functionality and safety. Look for signs of water leaks, faulty wiring, or outdated plumbing systems that may require repairs or upgrades.

Interior and Exterior Condition: Assess the overall condition of the interior and exterior spaces, including walls, ceilings, floors, doors, and windows. Look for signs of wear and tear, mold, dampness, or pest infestation that may need attention.

Utilities and Amenities: Test the functionality of utilities such as water supply, heating, ventilation, and air conditioning (HVAC) systems. Inspect amenities such as elevators, parking facilities, and common areas in multi-unit properties.

Environmental Factors: Consider environmental factors such as sunlight exposure, ventilation, noise levels, and air quality. Evaluate the surrounding area for potential sources of pollution, traffic congestion, or other environmental hazards.

Checklist for Due Diligence Before Finalizing the Purchase

Before finalizing the purchase, buyers should complete the following due diligence checklist:

Verify Property Documents: Ensure that all property documents, including title deeds, sale agreements, and property tax receipts, are in order and legally valid.

Obtain Encumbrance Certificate: Obtain an encumbrance certificate from the local sub-registrar's office to verify that the property is free from any legal encumbrances or liabilities.

Review Building Approvals: Check for building approvals and clearances from local authorities and regulatory bodies to ensure that the property complies with zoning and construction regulations.

Conduct Property Survey: Consider conducting a property survey to verify the boundaries, dimensions, and land use classification of the property.

Evaluate Property Value: Obtain a professional valuation of the property to assess its market worth and ensure that the purchase price is reasonable and fair.

Consult Legal Experts: Seek advice from legal experts or property lawyers to review the documentation, identify potential risks, and clarify any legal issues or concerns.

By following this due diligence checklist and conducting a thorough property inspection, buyers can mitigate risks, make informed decisions, and proceed with confidence towards finalizing the purchase of their dream home.

Negotiating the Deal

Strategies for Negotiating the Price

Negotiating the price of a property requires strategy and preparation. Consider the following tips:

Research Comparable Properties: Conduct research on similar properties in the area to determine their selling prices. This information will provide leverage during negotiations and help you make a reasonable offer.

Identify Property Flaws: Highlight any flaws or issues discovered during the property inspection to negotiate a lower price or request repairs or renovations as part of the deal.

Set Your Maximum Budget: Establish a maximum budget and stick to it during negotiations. Avoid getting emotionally attached to the property and be prepared to walk away if the seller's asking price exceeds your budget.

Be Willing to Compromise: Negotiation is a give-and-take process. Be prepared to compromise on certain aspects of the deal while staying firm on your non-negotiables.

Importance of Hiring a Real Estate Agent

While negotiating directly with sellers or developers is an option, hiring a real estate agent can offer several advantages:

Market Expertise: Real estate agents have in-depth knowledge of the local market trends, property values, and negotiation strategies. They can provide valuable insights and guidance throughout the negotiation process.

Negotiation Skills: Experienced real estate agents are skilled negotiators who can advocate on your behalf, communicate effectively with sellers, and negotiate the best possible terms and price for the property.

Legal Protection: Real estate agents can help navigate complex legal procedures, review contracts, and ensure that all legal requirements are met, providing you with peace of mind and protection against potential risks.

Time and Convenience: Hiring a real estate agent saves you time and effort by handling negotiations, paperwork, and communication with sellers on your behalf, allowing you to focus on other aspects of the home buying process.

Tips on Handling Counteroffers and Closing the Deal Successfully

When faced with counter offers or nearing the closing stage, consider the following tips:

Respond Promptly: Respond to counteroffers promptly to keep the negotiation process moving forward. Delaying your response may give the impression of disinterest or lead the seller to consider other offers.

Stay Flexible: Remain open to negotiating terms such as closing date, repairs, or concessions to reach a mutually beneficial agreement.

Review Contract Terms Carefully: Before closing the deal, review the contract terms and conditions carefully with your real estate agent or legal advisor to ensure that all agreed-upon terms are accurately reflected in the agreement.

Prepare for Closing Costs: Be prepared for closing costs such as legal fees, stamp duty, registration charges, and property taxes. Factor these expenses into your budget to avoid any last-minute surprises.

By employing effective negotiation strategies, considering the benefits of hiring a real estate agent, and handling counteroffers and closing the deal with diligence, you can navigate the negotiation process successfully and secure the property on favorable terms.

Closing the Deal and Post-Purchase Checklist

Closing Process: Signing Contracts and Transferring Ownership

The closing process involves several crucial steps to finalize the property purchase:

Signing Contracts: Review the final sale agreement and other relevant documents with your legal advisor or real estate agent. Ensure that all terms and conditions are accurately reflected, including the purchase price, payment schedule, and possession date. Once satisfied, sign the contracts and agreements.

Payment of Closing Costs: Arrange for the payment of closing costs, including stamp duty, registration fees, legal charges, and any outstanding dues. These expenses vary depending on the property value and location, so be prepared to cover them before completing the transaction.

Transfer of Ownership: Complete the formalities for transferring ownership of the property. This typically involves registering the sale deed and other legal documents with the local registrar's office. Ensure that all necessary paperwork is in order and that the property title is transferred to your name legally.

Post-Purchase Checklist for New Homeowners

After closing the deal and taking possession of the property, new homeowners should complete the following checklist:

Change Locks and Security Codes: For security purposes, change the locks and security codes for the main entrance, doors, and windows of the property. This helps safeguard against unauthorized access and ensures your safety and privacy.

Utilities Setup: Arrange for the setup of essential utilities such as electricity, water, gas, and internet services. Contact the respective service providers to transfer existing connections or install new connections as needed.

Home Insurance: Consider purchasing home insurance to protect your investment against unforeseen events such as natural disasters, theft, or damage. Compare insurance policies and choose one that offers comprehensive coverage at an affordable premium.

Property Maintenance: Develop a maintenance plan to keep your property in optimal condition. Schedule regular inspections, repairs, and upkeep tasks for systems such as plumbing, electrical, HVAC, and roofing to prevent costly issues down the line.

Update Address and Contact Information: Update your address and contact information with relevant authorities, service providers, banks, insurance companies, and government agencies. Notify friends, family, and business contacts of your new address to ensure seamless communication.

Advice on Maintaining Financial Discipline Post-Purchase

Maintaining financial discipline is essential for long-term financial stability and homeownership success. Consider the following tips:

Budgeting: Create a monthly budget that accounts for mortgage payments, utilities, maintenance costs, insurance premiums, and other recurring expenses. Stick to the budget to avoid overspending and ensure that you can meet your financial obligations comfortably.

Emergency Fund: Build an emergency fund to cover unexpected expenses such as home repairs, medical emergencies, or job loss. Aim to save three to six months' worth of living expenses in a separate savings account to provide financial security and peace of mind.

Debt Management: Manage debt responsibly by paying off high-interest loans and credit card balances promptly. Avoid taking on additional debt unless necessary and prioritize debt repayment to reduce financial strain and improve your credit score.

Long-Term Planning: Plan for long-term financial goals such as retirement savings, education funds for children, and wealth accumulation. Invest in diversified assets such as stocks, bonds, and retirement accounts to build wealth over time and secure your financial future.

By following the closing process diligently, completing a post-purchase checklist, and maintaining financial discipline post-purchase, new homeowners can navigate the transition smoothly and enjoy the benefits of homeownership responsibly.

Summary of Key Points

In this comprehensive guide to home buying for first-time buyers in India, we've covered essential aspects of the home buying process, including:

- Understanding your needs and budget to make informed decisions.

- Researching locations and property types to find the perfect fit.

- Exploring financing options and understanding the mortgage process.

- Navigating legalities and documentation to ensure a smooth transaction.

- Conducting property inspections and due diligence to avoid surprises.

- Negotiating the deal effectively to secure favorable terms.

- Closing the deal and completing a post-purchase checklist for a seamless transition.

- Maintaining financial discipline post-purchase to safeguard your investment.

Each step is crucial in guiding first-time homebuyers through the complex process of purchasing a home in India, empowering them to make informed decisions and achieve their homeownership dreams.

Encouragement to Take Your Proactive Steps Towards Homeownership

Now that you're equipped with the knowledge and insights to navigate the home buying process, it's time to take proactive steps towards homeownership. Whether you're a young professional, a growing family, or someone looking to invest in real estate, owning a home is a significant milestone that offers stability, security, and a sense of accomplishment.

By taking proactive steps such as:

- Assessing your needs and budget realistically.

- Researching properties and locations thoroughly.

- Exploring financing options and getting pre-approved for a mortgage.

- Engaging with legal experts and real estate professionals.

- Conducting thorough inspections and due diligence.

- Negotiating the deal effectively.

- Completing the purchase process diligently

you can navigate the complexities of the real estate market with confidence and clarity, ultimately achieving your goal of homeownership in India.

Follow us on

Do you have any plans for future investments!

Investing in real estate can be successful, but going it alone can be challenging and highly risky. Not to worry, We got you covered. We assist you in locating spacious plots and luxurious homes. Together, we can shape your destiny.

Contact Us `

`