How to Invest in Real Estate in India 2024: The Definitive Guide to Start your Investment Journey

Coimbatore

As we step into 2024, the Indian real estate market stands at an intriguing juncture, presenting both challenges and opportunities for investors.

With evolving market dynamics, shifting consumer preferences, and regulatory reforms reshaping the landscape, navigating the realm of real estate investment in India requires a keen understanding of market trends, strategic foresight, and informed decision-making.

In this comprehensive guide, we delve into the intricacies of real estate investment in India in 2024, offering valuable insights, actionable tips, and expert advice to help investors seize the potential of this dynamic market.

Whether you're a seasoned investor seeking to diversify your portfolio or a novice looking to embark on your investment journey, this guide will equip you with the knowledge and strategies needed to navigate the complexities of the Indian real estate sector and achieve your financial goals.

What is Real Estate Investment?

Real estate investment is the process of buying or acquiring the ownership, management, rental, or selling of properties such as land, residential properties, commercial buildings, or industrial spaces for the purpose of generating income, profit, and/or building wealth.

Real estate is one of the most common forms of investment globally and very lucrative investment strategies followed by the investor commonly in the terms of wealth creation all over the world.

Typically Real estate investment involves the purchase of own residential properties like living homes/houses or purchasing other residential properties, commercial buildings, or industrial spaces for generating rental incomes and the profits due to growth of the value of the property in the long term.

Let’s dive into the blogpost with a clear cut meaning of Real estate investment.

The Overview of the Real Estate in India 2024

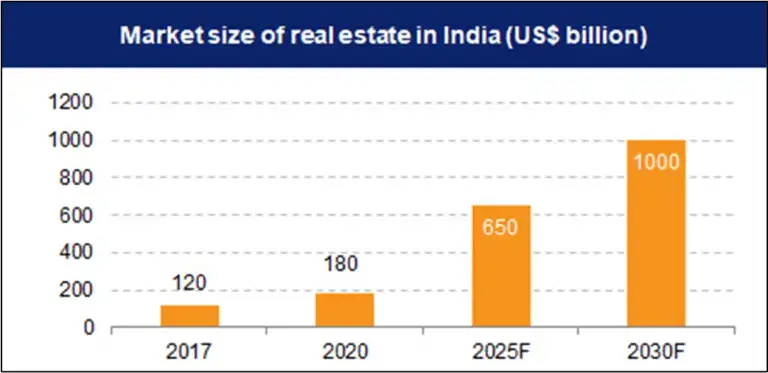

The Real Estate market in India is experiencing enormous growth in recent years. This unimaginable growth triggered due to the factors including demand for residential homes, expansion of urbanization, and the favorability of government policies, and rise of disposable incomes.

The Economic Times of India revealed that the Indian residential real estate market is predicted to sustain the consistent growth in 2024 and the property sales are projected to increase by 10-15% to over 3,00,000 units.

In the Perspective of the Indian economy,the Indian Real estate market plays a huge role in India's largest economic landscape. India’s economy is the 5th largestgrowing economy in the world with the value of 4,113 US Billion Dollar GDP.

In this enormous value,the Indian real estate market has a contribution of 7.3% (valued to $477 billion dollar) to the nation’s GDP and is expected to contribute 15.5% to the overall economic output of the nation by 2047.

What are 9 Importance of Real Estate Investment as a wealth-building strategy?

In the perspective of wealth creation, Real estate investments holds significant role in the wealth building strategy, The 9 Importance are of Real estate investments listed below,

Long-Term Appreciation:

Real estate properties have historically appreciated in value over the long term, providing investors with potential capital gains. While short-term fluctuations may occur, real estate tends to appreciate over time, especially in high-demand areas with limited supply.

Passive Investment Opportunities:

Real estate investments offer passive income streams, allowing investors to earn money with minimal ongoing effort or active involvement. This passive income can provide financial freedom and flexibility, allowing investors to pursue other interests or ventures.

Income Generation:

Real estate investments can generate regular income through rental payments from tenants. This steady stream of cash flow can provide investors with a reliable source of passive income, which can be reinvested or used to cover expenses.

Diversification:

Investing in real estate allows investors to diversify their investment portfolios beyond traditional asset classes like stocks and bonds. Real estate typically has low correlation with other asset classes, meaning it can help reduce overall portfolio risk and increase stability.

Inflation Hedge:

Real estate assets have intrinsic value and tend to appreciate in price over time, making them effective hedges against inflation. As the cost of living increases, real estate values and rental income typically rise, preserving the purchasing power of investors' capital.

Tax Benefits:

Real estate investors may benefit from various tax advantages , including deductions for mortgage interest, property taxes, depreciation, and certain expenses related to property management and maintenance. Additionally, long-term capital gains on real estate investments may be subject to favorable tax treatment.

Leverage:

Real estate properties have historically appreciated in value over the long term, providing investors with potential capital gains. While short-term fluctuations may occur, real estate tends to appreciate over time, especially in high-demand areas with limited supply.

Tangible Asset:

Real estate properties have historically appreciated in value over the long term, providing investors with potential capital gains. While short-term fluctuations may occur, real estate tends to appreciate over time, especially in high-demand areas with limited supply.

Portfolio Stability:

Real estate properties have historically appreciated in value over the long term, providing investors with potential capital gains. While short-term fluctuations may occur, real estate tends to appreciate over time, especially in high-demand areas with limited supply.

Understanding the India’s current Real Estate Landscape

India's real estate sector stands as a critical pillar of the nation's economy, reflecting both its dynamic growth and its complexities. With a population exceeding 1.3 billion and rapid urbanization underway, the demand for housing, commercial spaces, and infrastructure has surged.

Against this backdrop, understanding the current landscape of India's real estate market becomes imperative for investors, policymakers, and stakeholders alike. This introductory exploration seeks to shed light on the multifaceted dimensions shaping India's real estate sector today.

At the heart of India's real estate landscape lies a confluence of factors ranging from regulatory reforms to market dynamics and socio-economic trends.

Over the past decade, the sector has witnessed significant transformations driven by government initiatives such as the Real Estate (Regulation and Development) Act, 2016 (RERA), aimed at enhancing transparency and accountability.

Moreover, the Goods and Services Tax (GST) regime and policies like "Housing for All" have further influenced the market dynamics, fostering both challenges and opportunities. Understanding these regulatory frameworks and their implications is fundamental to navigating the intricacies of India's real estate sector.

India’s Real estate Market Top Trends in 2024

As the year 2024 unfolds, India's real estate market continues to evolve amidst a backdrop of shifting economic, social, and technological landscapes.

From the bustling metropolitan hubs to emerging suburban corridors, the dynamics of the real estate sector in India reflect a tapestry of trends that shape the investment climate and consumer behavior.

In this brief exploration, we delve into the key trends driving India's real estate market in 2024, offering a glimpse into the forces shaping the industry's trajectory and implications for stakeholders across the spectrum.

Let us take a look at some of the top real estate trends in 2024 that are predicted to rule the indian real estate market

Sustainable Development Initiatives:

With growing environmental consciousness and regulatory focus on sustainability, real estate developers are increasingly integrating eco-friendly practices into their projects. This includes the adoption of green building standards, renewable energy sources, and efficient water management systems to reduce carbon footprints and enhance long-term sustainability.

Tech-Driven Innovation:

The real estate sector is witnessing a profound impact of technology, with trends such as Proptech (Property Technology) gaining momentum. From virtual property tours and augmented reality to blockchain-based transactions and AI-driven predictive analytics, technology is revolutionizing various aspects of the industry, enhancing efficiency, transparency, and customer experience.

Rise of Co-Living and Co-Working Spaces:

As urbanization accelerates and lifestyles evolve, the demand for flexible living and working spaces is on the rise. Co-living and co-working concepts are gaining popularity, catering to the needs of millennials and young professionals seeking community-oriented living arrangements and collaborative work environments.

Affordable Housing Initiatives:

Addressing the housing needs of the burgeoning urban population remains a priority for the Indian government and real estate developers. Affordable housing schemes and incentives are driving the development of budget-friendly residential projects, aimed at expanding homeownership opportunities and addressing the housing shortage in urban centers.

Shift Towards Integrated Developments:

Integrated mixed-use developments that combine residential, commercial, retail, and recreational components are gaining traction. These developments offer convenience, connectivity, and a holistic lifestyle experience, catering to the preferences of modern urban dwellers seeking convenience and amenities within close proximity.

Emphasis on Health and Wellness Amenities:

In light of the COVID-19 pandemic, there is a heightened focus on health and wellness amenities in real estate developments. Features such as open green spaces, fitness centers, and contactless technologies are becoming essential considerations for homebuyers and tenants, reflecting a growing emphasis on well-being and safety.

Which Factors Influenced the Real estate Market?

The Indian real estate market is influenced by numerous factors that have contributed to its growth and evolution. Some of the key influences include:

1.Location and Amenities:

Properties located in areas with easy access to essential amenities, such as schools, hospitals, shopping centers, and transport hubs, command higher prices.

2.Urbanization and Population Growth:

Rapid urbanization and population growth have driven demand for residential and commercial properties in major cities.

3.Supply and Demand:

Imbalances between supply and demand caused by population growth, urbanization, and migration patterns have a significant impact on property prices.

4.Infrastructure Development:

Improved infrastructure, such as new roads, bridges, metro lines, or airports, can positively impact property prices by enhancing connectivity and accessibility.

5.Economic Conditions:

Stable and growing economies, along with positive business environments, can drive demand for real estate, leading to price appreciation.

6. Fluctuations in Interest Rates:

Changes in interest rates can impact housing affordability and property prices.

7. Employment Rates:

High employment rates encourage people to invest in real estate.

8.Disposable Income:

Increasing disposable income leads to greater demand for housing and commercial properties.

9.Government Initiatives:

Policies such as the "Housing for All" program and the Real Estate (Regulation and Development) Act (RERA) have encouraged investment in real estate.

10.Technological Advancements:

Technologies such as PropTech are reshaping the real estate landscape.

11.Sustainability:

Green building practices and a focus on sustainable living are increasingly important factors in the real estate market.

These factors interact dynamically, contributing to the growth and evolution of the Indian real estate market.

What are the Benefits of Investing in Real Estate in India?

Investing in real estate in India offers a myriad of benefits that attract investors both domestically and internationally.

With its rapidly growing economy, burgeoning population, and urbanization trends, India presents a lucrative opportunity for those seeking to diversify their investment portfolios and capitalize on long-term wealth creation.

Potential of creating Long-term wealth

Despite occasional fluctuations, India's real estate market has historically exhibited strong long-term growth trends. Growing disposable incomes, increasing urbanization, and government programmes supporting infrastructure development.

There are ample opportunities for capital appreciation, especially in emerging urban centers and satellite towns.

Hedge against inflation

Investing in real estate helps investors diversify their risk by distributing it across a variety of asset types.

By adding real estate to a diversified investment portfolio that includes equities, bonds, and other assets, investors can reduce overall portfolio volatility and enhance risk-adjusted returns.

Diversification of investment portfolio

Investing in real estate enables investors to spread their risk profile by distributing it across a wide range of types of assets.

By adding real estate to a diversified investment portfolio that includes equities, bonds, and other assets, investors can reduce overall portfolio volatility and enhance risk-adjusted returns.

Rental income opportunities

The demand for rental properties remains robust in India, driven by factors such as demographic shifts, employment opportunities in urban areas, and a growing migrant population.

Investors can benefit from steady rental income streams, which can serve as a source of passive income and contribute to overall portfolio returns.

Tangible Asset with Intrinsic Value

Unlike stocks or bonds, real estate represents a tangible asset with inherent value. Land and property holdings provide a sense of security and stability, offering investors a physical asset that can be utilized, developed, or rented out for income generation.

Favorable Regulatory Environment

Regulatory reforms such as the Real Estate (Regulation and Development) Act, 2016 (RERA) have brought increased transparency and accountability to the Indian real estate sector, boosting investor confidence.

Additionally, policies promoting foreign direct investment (FDI) in real estate have opened up opportunities for international investors looking to participate in India's burgeoning property market.

Emerging Trends and Opportunities

India's real estate market is witnessing the emergence of new trends such as sustainable development, integrated townships, and technology-driven innovations.

Investors can capitalize on these trends by identifying niche opportunities and investing in sectors poised for growth, such as affordable housing, logistics, and warehousing infrastructure.

What are the 6 types of Real Estate Investments in India?

Focusing into the world of real estate investments in India unveils a diverse array of options tailored to meet various investor preferences and financial goals.

From traditional residential properties to commercial ventures and specialized real estate funds, the Indian market offers a spectrum of investment avenues ripe with potential.

Residential properties Investments

Residential real estate remains one of the most popular investment options in India. Investors can purchase apartments, villas, or plots of land with the intention of earning rental income or capital appreciation.

Residential properties cater to both end-users and investors, offering a stable investment avenue with potential for long-term growth.

Commercial properties Investments

Commercial real estate includes office spaces, retail outlets, shopping malls, and industrial properties. Investing in commercial properties in prime locations can yield significant rental income and capital appreciation.

With the growth of India's urban centers and corporate sector, commercial real estate presents lucrative opportunities for investors seeking higher returns.

Plots/Lands Investments

Investing in land for development purposes involves purchasing undeveloped or underdeveloped land with the intention of subdividing, rezoning, or constructing residential or commercial properties.

Land development projects require careful planning, regulatory compliance, and market analysis but offer the potential for substantial returns upon completion.

REITs (Real Estate Investment Trusts) Investments

Investment companies known as REITs combine the money of several investors to purchase income-producing real estate assets including hotels, commercial buildings, and infrastructure projects.

REITs provide investors with an opportunity to participate in real estate markets with lower entry barriers, regular income distributions, and potential capital appreciation.

Real Estate Mutual Funds Investments

A diverse portfolio of real estate assets, including residential, commercial, and industrial buildings, is invested in by real estate mutual funds.

These funds are managed by professional fund managers and offer investors exposure to the real estate market with the flexibility of liquidity, diversification, and professional management.

Real Estate Crowdfunding

Real estate crowdfunding platforms enable investors to participate in real estate projects by pooling funds with other investors. These platforms typically offer opportunities to invest in a range of projects, including residential, commercial, and mixed-use developments.

Real estate crowdfunding provides investors with access to a diversified portfolio of projects with varying investment sizes and risk profiles.

What are Legal and Regulatory Considerations you follow for Real Estate Investments in India ?

When considering Real estate investments in India, it's essential to adhere to various legal and regulatory considerations to ensure compliance and mitigate risks. Some of the key factors to consider include:

Land acquisition laws

Understanding the legal framework governing land acquisition and development is crucial for real estate investors in India. This includes compliance with land acquisition laws, zoning regulations, environmental clearances, and other statutory approvals required for land development projects.

Title Verification and Due Diligence

Conducting thorough title verification and due diligence is crucial before investing in real estate in India.

This includes verifying land titles, conducting property searches, assessing encumbrances, and ensuring compliance with local laws and regulations to mitigate legal risks associated with ownership and transfer of property.

Taxation policies related to real estate investments

Real estate investments in India are subject to various tax laws, including income tax, capital gains tax, stamp duty, and goods and services tax (GST).

Understanding the tax implications of real estate transactions and structuring investments tax-efficiently is essential for optimizing returns and ensuring compliance with applicable tax laws.

Foreign Exchange Management Act (FEMA)

Foreign investors must comply with FEMA regulations governing foreign investment in Indian real estate. This includes regulations related to repatriation of funds, permissible investment routes, and compliance with sectoral caps and conditions for foreign direct investment (FDI) in real estate.

Compliance with RERA (Real Estate Regulation and Development Act)

Compliance with RERA regulations is paramount for all real estate transactions in India.

RERA aims to promote transparency, accountability, and efficiency in the real estate sector by mandating registration of real estate projects, timely delivery of projects, and protection of buyers' interests through disclosure requirements and dispute resolution mechanisms.

Contractual Agreements and Documentation

Execution of legally binding agreements and documentation is integral to real estate transactions in India.

Investors should ensure comprehensive contractual agreements, including sale deeds, lease agreements, development agreements, and joint venture agreements, to protect their interests and clarify rights and obligations of parties involved in the transaction.

How to do Financial Planning for Real Estate Investment?

Financial planning for real estate investment involves careful consideration of various factors to ensure sound decision-making and optimal returns. Here have a few tips to help you get started:

Setting Investment Goals

Whether your goal is portfolio diversification, long-term financial appreciation, or rental income generation, start by outlining your investing objectives.

Clearly articulate your financial goals, risk tolerance, and time horizon to guide your investment strategy.

Calculate Investment Returns

Estimate the potential returns and risks associated with different real estate investment opportunities. Consider factors such as rental income, property appreciation, operating expenses, financing costs, and taxes to calculate projected cash flows and returns on investment.

Budgeting and financial projections

Establish a budget for your real estate investment, taking into account property acquisition costs, renovation expenses, ongoing maintenance, property taxes, and insurance premiums.

Develop a financing plan that aligns with your budget and financial goals, whether it involves self-funding, mortgages, or other financing options.

Perform Due Diligence

Before making any investment decisions, conduct thorough due diligence on prospective properties. Evaluate property condition, location, marketability, rental potential, legal compliance, and regulatory approvals to assess investment risks and identify potential pitfalls.

Monitor and Review

Continuously monitor the performance of your real estate investments and regularly review your financial plan to ensure alignment with your goals and market conditions.

Adjust your investment strategy as needed to capitalize on opportunities or mitigate risks in response to changing economic or market conditions.

How to create a Real Estate Investment Strategy?

Creating a Real estate investment strategy involves a systematic approach to identifying opportunities, setting goals, and executing a plan to achieve desired outcomes.

Short-term vs. long-term investment goals

Short-term Goals:

Short-term investment goals typically involve objectives that can be achieved within a few years, such as generating immediate cash flow, flipping properties for quick profits, or taking advantage of short-term market opportunities.

Investors with short-term goals may prioritize properties with high rental yields, rapid appreciation potential, or renovation opportunities that can add value quickly.

Long-term Goals:

Long-term investment goals focus on building sustainable wealth and financial security over an extended period, often spanning decades. Long-term investors may prioritize properties with stable rental income, strong potential for capital appreciation, and favorable market fundamentals.

They may also seek to leverage the power of compounding by reinvesting profits into additional properties or using 1031 exchanges to defer capital gains taxes.

Portfolio diversification strategies

Asset Allocation:

Diversifying across different types of real estate assets, such as residential, commercial, industrial, and retail properties, can help spread risk and enhance portfolio stability.

Investors may allocate capital based on factors like risk tolerance, investment horizon, and market conditions.

Geographic Diversification:

Investing in properties across diverse geographic locations can mitigate regional economic risks and capitalize on emerging growth opportunities.

Investors may consider factors such as population growth, job markets, infrastructure development, and local market dynamics when selecting investment locations.

Property Type Diversification:

Within each asset class, investors can further diversify their portfolios by investing in various property types, such as single-family homes, multifamily buildings, office spaces, retail centers, and industrial warehouses.

Every sort of property has a unique risk-return profile, and depending on the state of the market, it may perform differently.

Exit strategies

Selling:

Selling a property can be a primary exit strategy for investors looking to realize capital gains or liquidate underperforming assets.

Timing the sale strategically based on market conditions, property appreciation, and tax implications is crucial for maximizing profits.

Renting:

Within each asset class, investors can further diversify their portfolios by investing in various property types, such as single-family homes, multifamily buildings, office spaces, retail centers, and industrial warehouses.

Every sort of property has a unique risk-return profile, and depending on the state of the market, it may perform differently.

Property Type Diversification:

Within each asset class, investors can further diversify their portfolios by investing in various property types, such as single-family homes, multifamily buildings, office spaces, retail centers, and industrial warehouses.

Every sort of property has a unique risk-return profile, and depending on the state of the market, it may perform differently.

Exit strategies

Selling

Selling a property can be a primary exit strategy for investors looking to realize capital gains or liquidate underperforming assets.

Timing the sale strategically based on market conditions, property appreciation, and tax implications is crucial for maximizing profits.

Renting

Renting out properties can provide a steady stream of rental income and long-term appreciation potential.

Investors may choose to hold onto properties indefinitely, especially in high-demand rental markets, to benefit from ongoing cash flow and property value appreciation.

Reinvesting

Reinvesting profits from property sales or rental income into additional real estate investments can help grow and diversify the investment portfolio over time.

Investors may use proceeds to acquire new properties, fund renovations, pay down debt, or explore alternative investment opportunities within the real estate sector.

Tips for Successful Real Estate Investment in India

Investing in real estate in India presents lucrative opportunities for wealth creation and financial growth in 2024.

With evolving market dynamics, favorable demographic trends, and supportive government policies, the Indian real estate sector continues to attract investors seeking both short-term gains and long-term stability.

However, navigating the complexities of the real estate market requires careful planning, diligent research, and informed decision-making.

Stay updated with market trends and news

Keep abreast of current market trends, economic indicators, and regulatory developments affecting the real estate sector in India. Follow reputable news sources, industry reports, and market analyses to make informed investment decisions.

Network with industry professionals

Build relationships with real estate agents, brokers, property managers, legal advisors, and other industry professionals to gain insights, access investment opportunities, and stay connected with market developments.

Seek professional advice

Consult with Financial advisors, Legal experts, Tax consultants, and

Real estate investors may benefit from various Real estate agents or Professionals to get personalized advice tailored to your investment objectives, risk tolerance, and financial situation.

Professional guidance can help you make informed decisions and navigate complex aspects of real estate investment.

Start small and gradually scale up investments

Begin your real estate investment journey with modest investments in properties that align with your budget, risk tolerance, and investment objectives.

Consider starting with residential properties, single-family homes, or small multifamily properties that offer relatively low entry barriers and manageable investment costs.

As you gain experience and confidence in real estate investing, gradually scale up your investments by diversifying your portfolio, exploring new asset classes, and leveraging financing options to acquire larger properties or undertake more ambitious projects.

Focus on building a well-balanced and diversified real estate portfolio over time.

Monitor and review investment performance regularly

Establish a system for tracking and evaluating the performance of your real estate investments on a regular basis. Monitor key metrics such as rental income, occupancy rates, property appreciation, cash flow, and return on investment (ROI).

Conduct periodic reviews and analysis of your investment portfolio to identify areas of strength, weakness, and opportunities for improvement. Adjust your investment strategies, allocate resources, and make informed decisions based on performance data and market insights.

Stay proactive and responsive to changes in market conditions, economic trends, and investment dynamics by continuously monitoring and optimizing your real estate portfolio to maximize returns and mitigate risks.

Conclusion

In conclusion, successful Real estate investment in India in 2024 requires a strategic approach, informed decision-making, and continuous learning.

Throughout this guide, we have explored essential tips and strategies to help you navigate the complexities of the real estate market and maximize your investment potential.

Summary of the main ideas covered in the guide

Stay updated with market trends:

Keep abreast of market trends, economic indicators, and regulatory developments to make informed investment decisions.Network with industry professionals:

Build relationships with real estate agents, financial advisors, and legal experts to access valuable insights and opportunities.Seek professional advice:

Consult with experts to develop a comprehensive investment strategy tailored to your goals and circumstances.Start small and scale up:

Begin with modest investments and gradually expand your portfolio as you gain experience and confidence.Monitor investment performance:

Regularly review the performance of your investments and adjust your strategies based on market conditions and performance data.We encourage you to take proactive steps towards Real estate investment in Coimbatore, leveraging the knowledge and resources provided in this guide.

By implementing these strategies and staying diligent in your approach, you can unlock the wealth-building potential of real estate and achieve your financial objectives in 2024 and beyond.

Follow us on

Do you have any plans for future investments!

Investing in real estate can be successful, but going it alone can be challenging and highly risky. Not to worry, We got you covered. We assist you in locating spacious plots and luxurious homes. Together, we can shape your destiny.

Contact Us `

`